Trusted by hundreds of financial institutions and global companies

A global leader in tech-enable advisory

Adda Analytics is the tech arm of the global multi-asset advisory firm Audere Solutions.

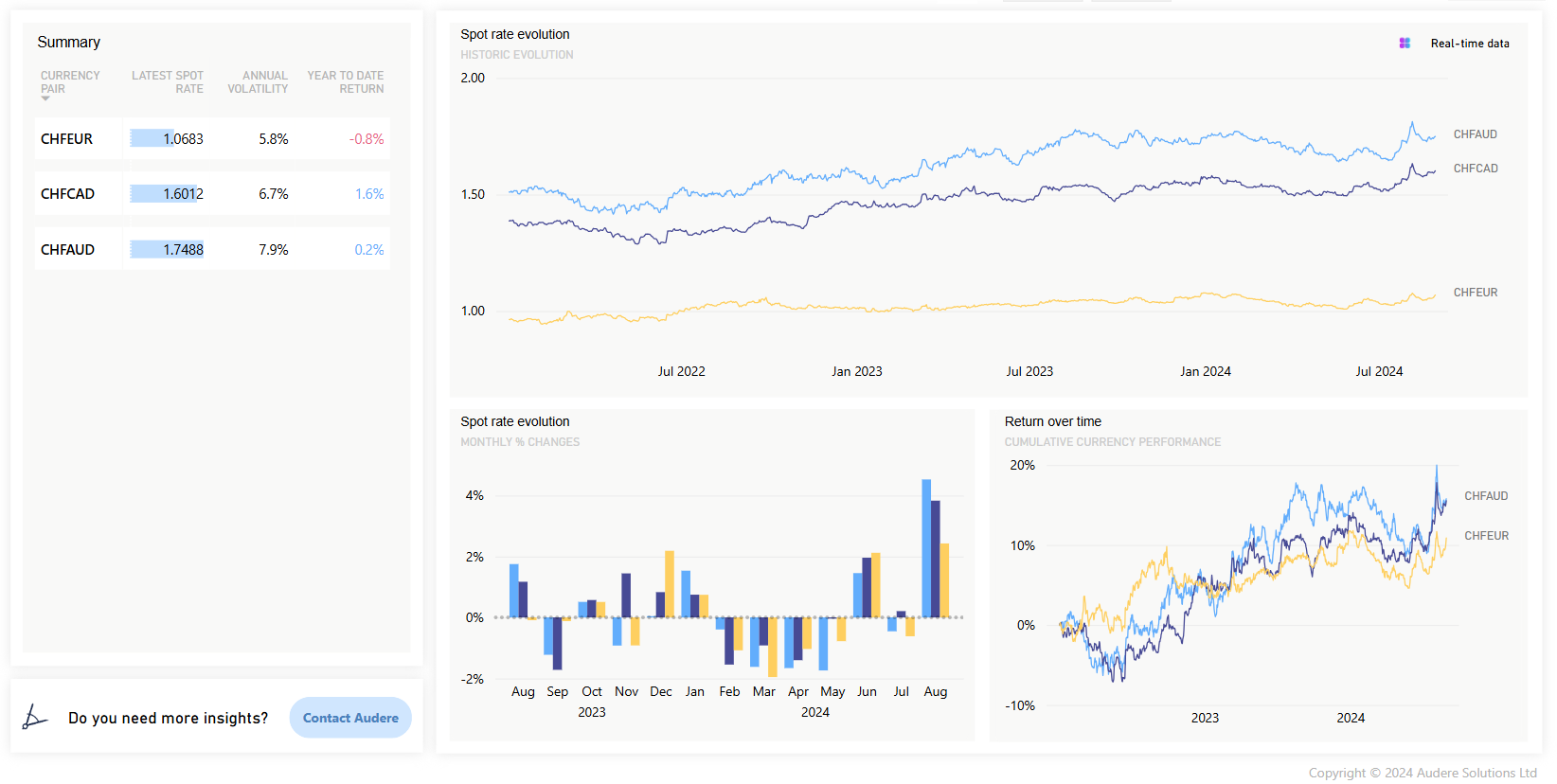

We provide companies with a smarter way to analyse their market risk, execution, and hedge implementation.

Our products remove the complexities and disjointed processes, to deliver advisory solutions with speed and controls that minimise risk and maximise performance.

Challenges facing clients...

The advisory and execution dynamics for servicing clients with a market exposure have remained time consuming, opaque, expensive, and at times, inefficient.

Audere is challenging these norms, find out more today by arranging a demo with a specialist advisor.

Lack of transparency

For years banks and brokers have benefited from the opaque foreign exchange market conditions - spreads can be hidden & hedging advice misdirected

!

Manual hedge tracking using error prone spreadsheets

Banks typically provide phone based or static documents to advise their clients - this lack of interactivity makes decision making less informed

!

Our business areas

Trade auditing & tenders

Benchmark the fx pricing you receive from bank / brokers, and thereafter tender for better terms

View more →

Identify currency risks at entity and group level and monitoring your hedging activity versus policy targets

View more →

Access the largest pool of bank and broker liquidity provision - accredited by Adda

View more →

Delivering hedge accounting solutions to support hedging programs - realise cost savings through our automation services

View more →

Private Equity

Uncover FX opportunities across your portfolio. Harness combined portfolio flows to cut costs for your companies

Corporates

Gain transparency on your FX margins and significantly reduce the costs while optimising your hedges

Funds

Automate the auditing of your FX transactions to adhere to regulatory requirements and show investors you receive best-execution

Charities

Empower your charity to receive the best FX pricing while improving your governance reporting for donars

Adda provided us with the analytics and insights to support the initial set up and implementation of our Treasury function. This included the management of our extensive business banking relationships and access to significantly improved FX pricing terms through an RFP process.

Their professional approach was efficient, flexible and highly beneficial which I’d recommend to other high growth businesses with global operations that are looking to mature their Treasury activities

Chris Roland, Head of Treasury, Lightsource BP

Current job openings

Ready to get started?

Contact us.

-

Human + AI

Automate FX & Interest Rate Monitoring

Optimise execution & hedging analytics

Go AI Adda for Foreign Exchange

Go AI Adda for Interest Rates